The Startup Lifecycle: From Conception to Scale

The Germination of Greatness: Ideation and Early Development

The journey of a startup begins with a spark of innovation, a solution to a problem not yet addressed. It's in these formative moments where visionaries craft the foundation of what could become the next disruptive business. The startup lifecycle kicks off with meticulous market research, identifying pain points, and recognizing potential demand. Often, this exploration phase involves a mix of data analysis, consumer behavior studies, and competitive scrutiny. By examining intellectual property landscapes, ambitious founders can carve out a niche for their visionary product or service.

Establishing the MVP: The Litmus Test for Startup Viability

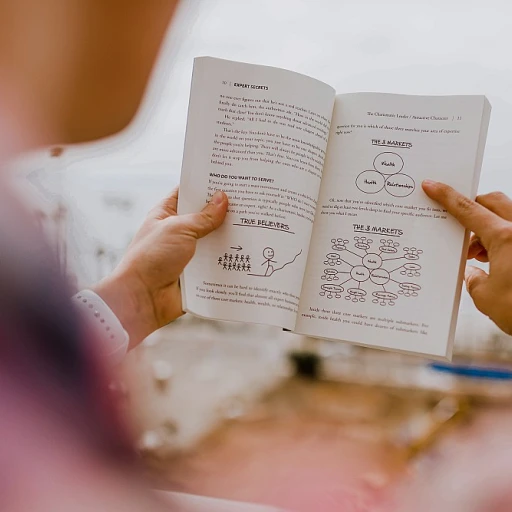

Deep in the startup forge, the concept of a minimum viable product (MVP) takes center stage. The MVP is the bare-bones version of the product, rolled out to test waters and gauge initial user reception. For instance, Eric Ries, in 'The Lean Startup', emphasizes the importance of MVPs in learning what resonates with customers and iterating rapidly. Crucial feedback loop during this phase can make or break the product's future, so engaging with the target audience is not just advisable, it's critical.

Sowing Seeds for Growth: Nurturing the Business Environment

Seed funding often marks a startup's first serious foray into the financial jungle. According to the 2021 Global Startup Ecosystem Report by Startup Genome, a solid 90% of successful startups are driven by strong ecosystems that include not just financial backing but also mentorship and networks. As cash flow is fundamental to survival, securing this initial investment, be it from angel investors, friends, family, or early-stage venture capital, offers a startup the lifeblood to progress beyond conception.

Branching Out: Balancing Focus with Scalability

As a startup evolves, it must navigate the delicate balance between finessing its core offering and setting the groundwork for scalability. This means solidifying its business model and streamlining operations to support swift and sustainable growth. An agile approach, often heralded by Silicon Valley gurus such as Reid Hoffman, co-founder of LinkedIn, insists on the importance of being able to pivot or adapt in response to market feedback. And remember, in this realm of startups, it's not just about a grand vision, it's about executing that vision effectively.

Thriving Amid Challenges: The Path to Scale

From here, the focus shifts from merely surviving to thriving. Growth stages can involve further product development, user base expansion, and, importantly, company culture cultivation. Building a team that shares the startup’s ethos and can function under the pressures of a high-growth environment becomes paramount. Talent acquisition and retention strategies often become as crucial as product features. The balance of maintaining startup agility with the need for structured processes poses an exciting challenge for founders and their leadership teams as they scale new heights.

Venture Capital and Funding Strategies for Startups

Fueling Startup Success: Smart Capital Investment Decisions

When startup founders set out to transform a spark of an idea into a booming business, the road ahead is often steep. It's a journey that demands more than just passion and innovation; it requires robust financial support. A startup's choice of funding strategies can be as critical to its trajectory as the product or service it offers. And with an ever-evolving investment landscape, founders must stay informed and agile to keep their dreams on track.

Finding the Right Investors

Securing the right mix of investment is a pivotal moment for founders. The search for capital is not just about the money—it's essentially about building a relationship with investors who believe in the mission of the startup and bring value beyond the dollar. With strategic networking, startups can attract venture capital firms, angel investors or even tap into government grants and crowdfunding platforms. Silicon Valley and New York City remain hotbeds of venture capital activity, but other tech hubs in the United States, Europe, and Israel are rapidly gaining ground, changing the geographic dynamics of funding.

Series Funding: From Seed to Scale

The series funding rounds—seed, A, B, C, and beyond—represent crucial checkpoints in a startup's life. Each round is an intersection of opportunity and scrutiny by potential investors. From early stage seed funding focusing on concept proof and minimum viable product (MVP) development to Series A and B rounds aimed at product-market fit and scaling operations, each stage sees an influx from various investment entities, including specialized tech startup investors. Founders need to be diligent in understanding the expectations of each round and prepare cogently for the scrutiny of their financials by potential stakeholders.

Metrics That Matter to Investors

For investors, pouring capital into a startup is a game of strategic bets grounded on metrics. Customer acquisition costs, lifetime value, burn rate, and revenue growth are just a few figures scrutinized before they open their wallets. A startup's ability to present a compelling story through their numbers can signify the difference between securing a check or walking away empty-handed.

Regulatory Navigation for Funding

Beyond convincing investors, startups must maneuver through the regulatory maze set by entities such as the Securities and Exchange Commission in the U.S. or corresponding authorities in other countries. Compliance with regulations is not optional and can impact a startup's access to capital as much as their business model or product innovation can.

Diverse Funding Options

In an age where innovation knows no boundaries, startups have a plethora of funding platforms at their disposal. From blockchain-based initial coin offerings to equity crowdfunding and peer-to-peer lending, each option offers different advantages and requires different considerations regarding equity, control, and future obligations.

When to Walk Away from Capital

Interestingly, not all money is good money. Founders need to recognize when a potential investment may come with strings attached that could prove too limiting or misaligned with their vision. Walking away from a bad fit, despite the allure of a financial boost, can be a defining strategic move, preserving the core mission and culture of the company.

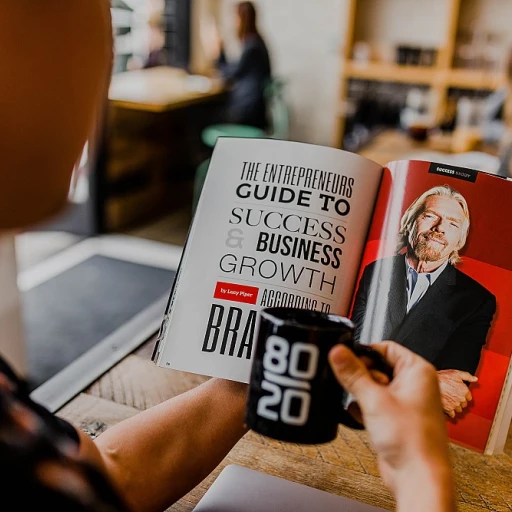

Expert Viewpoints: Fueling Innovation with Capital

Many industry leaders, like Marc Andreessen of Andreessen Horowitz, emphasize the role of smart capital in achieving not just growth, but sustainable and strategic scale. These experts often share insights through publications, podcasts, or at tech and startup events, and their observations can be incredibly valuable to founders plotting their funding roadmap.

Looking Ahead: The Future of Funding

As startups continue to disrupt traditional industries from financial services to real estate and beyond, the funding strategies they employ will need to adapt to the changing technological and economic environment. Trends such as the rise of machine learning and AI could influence how investors view the potential of startup companies, prompting shifts in where and how much they invest.

Surfing the waves of venture capital and funding isn't solely about steadying the ship through turbulent waters; it's about charting a course that aligns with the values, visions, and long-term objectives of a startup. And for those with the right combination of insight, understanding, and a dash of opportunism, the sea of investment holds treasures aplenty.

Cutting-Edge Technologies: AI and Machine Learning in Startup Growth

AI and Machine Learning: Supercharging Startup Growth

The advancement of artificial intelligence (AI) and machine learning has become the game-changer for startups striving to outpace competitors. While previous parts of this series discussed the lifecycle and funding aspects, it's the adoption of cutting-edge technologies that truly differentiates promising startups.

Leveraging AI and machine learning can streamline operations, personalize customer experiences, and deliver insights from large data sets that would otherwise be unmanageable. A study from PwC predicts AI could contribute up to $15.7 trillion to the global economy by 2030, with startups being at the forefront of this revolution. This emphasizes the strategic adoption of technology in accelerating startup growth.

Startups like Google Cloud offer machine learning services that supercharge growth, providing scalable solutions right from the early stage. With Google Startups Cloud Program, emerging companies can fine-tune their operations in real-time, enhancing products to fit market needs efficiently.

But it's not just tech juggernauts fueling the AI revolution. Select startups have flourished by focusing on niche markets such as financial services, leveraging AI to personalize customer offerings. For example, tech jobs companies use AI for tailored job matching, and startups in real estate implement machine learning algorithms to predict market trends, providing invaluable insights to investors and property seekers.

An often-cited example is an AI-powered management platform that transforms customer interactions. Founders leveraging AI reported a 50% reduction in resolution time, according to a survey by Deloitte Insights, catering to the ever-demanding need for swift and efficient customer service.

However, implementing these technologies comes with challenges. Concerns over data privacy and ethical use have led to controversies, necessitating startups to tread carefully. Companies must also deal with the Securities Exchange Commission (SEC) when implementing AI in financial services, ensuring compliance with all regulations.

For a deeper dive into the intricacies of balancing strategy and operational considerations in technology adoption, check out our piece on navigating success in company strategy. Here, we explore how startups can align their growth objectives with AI integration without compromising on compliance and ethically-sound operations.

Finding the Sweet Spot: Machine Learning Application Areas

A critical success factor is identifying where AI can yield the most significant results. Successful startups have homed in on processes such as customer relationship management, inventory forecasting, and predictive maintenance, where AI can bring about transformative results.

It's not just about throwing technology at problems; it's about finding that sweet spot where machine learning intersects with genuine business needs. A recent case study from McKinsey & Company illustrates how a startup used machine learning to improve its product recommendations, increasing cross-sell revenue by over 20%.

Startups are encouraged to iterate with a minimum viable product (MVP) focusing on a particular problem area. This 'start small and scale' approach helps in achieving product-market fit while maintaining lean operations.

Fitting AI into the Bigger Picture

As startups mature, the role of AI often evolves. What starts as a tool for managing customer interactions can grow into a comprehensive business intelligence platform, key to strategic decision-making. Incorporating AI into the broader business model demands a keen understanding of its capabilities and limitations.

Drawing attention to the significance of machine learning in modern business, investor and author Kai-Fu Lee, in his book 'AI Superpowers: China, Silicon Valley, and the New World Order,' highlights that AI is not just a product enhancement tool but a foundational technology that can drive entirely new business models.

Ultimately, AI can supercharge startup growth by offering smart, scalable solutions that cater to today's dynamic market. By harnessing the potential of AI and machine learning, startups not only stand to gain a competitive edge but can also set a new direction for the industry they're in.

Building the Dream Team: Startup Hiring and Talent Retention

The Pulse of Innovation: Stats on Tech Startups Hiring

Startups, the powerhouses of innovation, are more than just a trendy concept. They have become a vibrant part of the economy, especially within the tech sector. A recent report by Silicon Valley Bank indicates that a whopping 84% of startups plan on hiring this year, a clear sign of burgeoning growth. Founders are now constantly on the quest to attract the cream of the crop, aiming to grow their teams by an average of 20% (Silicon Valley Bank, 2022).

The Expert View on Building Your Core Team

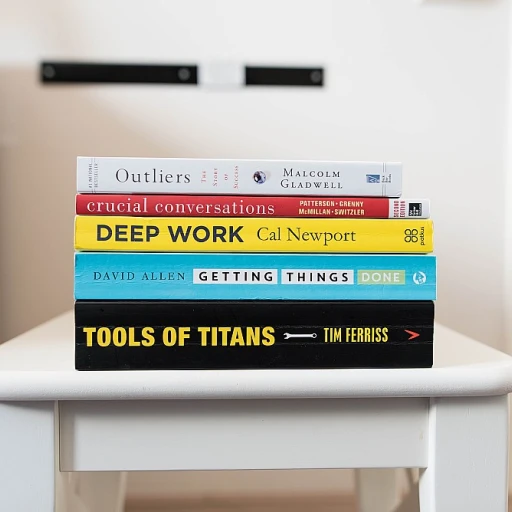

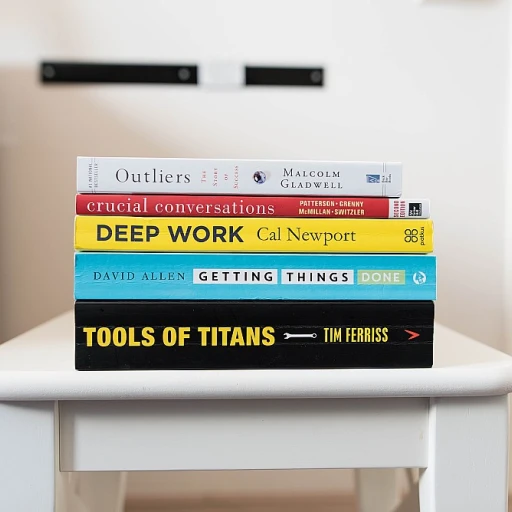

Ask any startup luminary, and they'll tell you that a winning team is not incidental; it's by design. Renowned venture capitalist and co-founder of Andreessen Horowitz, Ben Horowitz, emphasizes the importance of creating a cultural fit from the word go. His book, 'The Hard Thing About Hard Things', serves as a testament to cultivating a team that not only meets immediate needs but grows in unison with the company's grand vision.

Real Stories of Success and the Talent Behind Them

Behind every successful startup lies a tale of unwavering commitment and the right talent driving it. Take Google, for instance, a company that began its journey in a humble garage but credits its early team for its current status as an industry titan. Sergey Brin and Larry Page handpicked individuals who not only had the intellectual acumen but were also a cultural fit for Google's quirky, boundary-pushing ethos.

Tackling Employment Trends: From Flexi-Work to Full-Time

The workplace is evolving, and startups are at the forefront of this change. An interesting trend identified by the U.S. Bureau of Labor Statistics is the rise of 'alternative work arrangements'. As many as 16% of Americans are now engaged in some form of contract-based, part-time, or gig work. Startups, often with less bureaucracy than established corporations, are well-positioned to harness this shift and offer the flexible work environments highly sought-after by today’s top talent.

Talent Retention: More Than Just a Paycheck

Retaining the right talent is just as critical as hiring them. In this regard, the financial services industry has some compelling insights. A McKinsey study found that non-financial incentives can be just as, if not more, effective in retaining employees than financial ones. Younger startups, therefore, innovate with stock options, learning opportunities, and a solid company culture, avoiding a high turnover that could cost them between 50-60% of the employee's annual salary, as per the Society for Human Resource Management.

Best Practices in Startup Hiring

Attracting and securing top-notch talent requires more than just a savvy job listing. It involves understanding what drives today's ambitious career seekers. For instance, a survey by AngelList highlighted the importance of mission-driven work, with 71% of tech talent prioritizing value alignment over other job attributes. Likewise, robust internal processes and transparency about growth opportunities can significantly enhance appeal to prospective employees.

Nurturing the Next Generation of Leaders

To build for the future, startups need to invest in developing leaders from within. Industry trailblazers like Microsoft and Amazon have mentored fledgling startups, enabling access to their leadership training and resources. Such interventions not only build capacity but also reinforce a startup's ability to scale and innovate independently.

Analytics in Talent Management: The Competitive Edge

Going beyond gut feeling, data-driven approaches to hiring are gaining traction. Top-tier firms leverage platforms that can analyze vast pools of data to spot trends and predict hiring needs. This rigorous analytic process ensures that the right talent is in the position when they're needed to keep the wheels of innovation turning.

Product-Market Fit: Nailing Down What Customers Want

Decoding Product-Market Fit for Startups

Finding the sweet spot where a product irresistibly meets market demand is like striking gold for startups. Product-market fit has entrepreneurs buzzing because it stands at the heart of startup success. A study by Marc Andreessen, who coined the term, underlines its vitality stating that over 70% of startups fail due to premature scaling without achieving product-market fit first.

The Pillars of Product-Market Fit

Aspiring to hit the bullseye in terms of what your customers crave requires a blend of innovation and pragmatism. Eric Ries, author of 'The Lean Startup', advocates for startups to adopt a build-measure-learn feedback loop to refine their products in real time. Adopting minimum viable product (MVP) strategies can help early stage startups test waters with basic features before full-fledged development.

Defining product-market fit involves analyzing customer response: Are users returning? Do they recommend it to others? Quantifying satisfaction becomes crucial, as demonstrated by Sean Ellis's benchmark that if at least 40% of users declare they would be 'very disappointed' without your product, the startup could be on the right track.

The Customer Development Framework

Steve Blank's Customer Development Framework shines a light on understanding customer segments and their problems. This framework suggests startups pivot or persevere based on customer feedback, a process pivotal to fine-tuning product offerings. Success stories like Dropbox and Airbnb, which pivoted after listening to user feedback, reinforce the value of customer-centric development.

Funding Insights and Market Signals

With analytics in the driver's seat, startups bolster their chances of securing funding by demonstrating product-market fit. Data indicating strong user engagement and retention serve as signals to investors about a venture's potential. Reports by venture capital firms emphasize the investment community's reliance on these metrics when assessing startups.

The Lifecycle Link

Product-market fit isn't a static achievement but a dynamic goal that evolves with stages of the startup lifecycle. As startups scale, the fit must be reassessed and adapted. Silicon Valley investor Paul Graham notes that startups often have to make substantial changes to their product as they grow, emphasizing the continuous journey towards aligning with customer needs.

Cultural and Regional Nuances

In today's global arena, startups must recognize cultural and regional preferences. A product's reception can vary widely across markets, as seen in the disparate user bases of platforms like Uber in America versus Ola in India. Localization strategies and understanding regional market trends are therefore essential for startups eyeing expansion.

Case Studies: Reflecting on Real-World Examples

Real-world examples illuminate the path to product-market fit. Google's evolution from a simple search engine to a provider of a wide array of tech services exemplifies ongoing product-market alignment. The lessons from such tech giants weave a narrative of relentless pursuit of customer satisfaction and innovation.

In sum, product-market fit entails crafting a product that speaks the customer's language and solves real-world problems. With a meticulous approach to understanding user needs and market dynamics, startups can increase their winning odds significantly.

Location, Location, Location: The Strategic Geography of Startups

Why Startup Geography Matters

It's a common mantra in real estate and holds true in the startup ecosystem - location is everything. The strategic decision of where to base a startup has long-standing effects on access to talent, capital, and market opportunities. Silicon Valley, for instance, has become synonymous with tech innovation and venture capital. In 2021, the region accounted for an overwhelming percentage of U.S. venture capital spending. However, the tides are shifting, and new hubs are emerging in New York City, Boston, and outside the United States, in cities like Bangalore and Tel Aviv.

Viewing Profiles of Success: Regional Case Studies

Looking at successful startups, it's clear that some regions are manufacturing more unicorns than others. An analysis by Crunchbase reveals that, despite a global presence, the highest concentration of billion-dollar startups is still in the U.S. and China. However, regions such as Europe and India are rapidly catching up, with cities like Berlin and Bengaluru showcasing a significant uptick in successful tech startup launches, thanks to supportive government policies, an influx of skilled professionals, and a thriving entrepreneurial culture.

Funding Landscapes and Investor Ecosystems

In addition to the ability to attract top talent, the location of a startup greatly influences its funding opportunities. Venture capital firms, like Andreessen Horowitz and private equity players, are often concentrated in financial hubs or innovation epicenters. A startup in proximity to these financial service industries can benefit from networking opportunities and easier access to capital. For example, startups based in New York City have the advantage of proximity to Wall Street and a vast network of financial services experts.

The Role of Government and Industry Clusters

Government policy and the existence of industry-specific clusters can also dictate location strategy. For example, Canada's favorable immigration policies are attracting global tech talent and fueling growth in cities like Toronto and Vancouver. In the United States, Austin's emergence as a tech hub is bolstered by Texas' business-friendly environment. Furthermore, specialized clusters, like the life sciences corridor in Massachusetts, bring together academia, industry, and government, providing a fertile ground for biotech startups.

Leveraging Platforms and Infrastructure

Today’s startups also need robust technological infrastructure to flourish. Access to platforms like Google Cloud and Amazon's AWS can give companies a competitive edge by enabling them to scale quickly and efficiently. The Google Startups Cloud Program offers resources that help young companies leverage Google's powerful infrastructure and machine learning tools to 'supercharge startup growth.'

Aligning with Local Markets and Customers

A startup's location should resonate with its target customer demographics. For a business offering financial services, being located in financial hubs like New York or London could result in better market fit and customer access. A startup's geography can also dictate its hiring strategy, as the available talent pool varies significantly from one location to another. Tech startups, for instance, might prioritize locations known for their tech jobs companies and A.I. research centers.

Overcoming the Location Constraint

While a strategic location can provide numerous advantages, modern technology also allows startups to thrive in less traditional environments. Remote work and digital communication platforms are leveling the playing field, enabling access to global talent and markets irrespective of geographical boundaries. This new norm pushes founders to think beyond physical constraints when building their company's strategic geographic presence.

Going Global: Startups on the World Stage

Expanding Your Startup's Horizons: Stepping into International Markets

For many startups, the aspiration to make an impact on a global scale is the pinnacle of success. However, stepping onto the world stage is not just about ambition; it's a strategic decision backed by data, trends, and expert insights.

Understanding the Global Landscape

The transition from a local or regional market to international presence must be navigated with a blend of savvy and caution. A report from the Harvard Business Review highlighted that startups going global have grown in numbers, with companies in tech jobs and sectors such as Google Cloud witnessing an uptick in reach and influence. A startup's choice to go global often correlates with trends in digital transformation and the borderless nature of services.

Experts like the team from Andreessen Horowitz offer case studies on companies that successfully navigated this transformation, underscoring the importance of understanding local markets without neglecting the unique proposition of one's product or service.

Strategic Partnerships and Local Insights

One path to global success is entering strategic partnerships. Collaboration with local entities can supercharge startup growth, offering insights into cultural nuances and regulatory environments. For instance, New York-based startups may form alliances with partners in Europe or Asia to gain real-time, practical knowledge that 'ground truth' their expansion strategy.

According to experts from New York City's tech scene, startups which embrace local partnerships can often bypass common roadblocks such as cultural misunderstandings or compliance issues.

Funding and Financial Considerations Abroad

While vision and partnerships are crucial, financial backing remains a keystone of international expansion. Securing capital from investors interested in global markets or from venture capital firms with an international focus can fuel the necessary resources for making the leap abroad. A study by Silicon Valley Bank Report indicates that early stage startups that prove product-market fit can attract international investors, particularly if they target financial services or other high-growth industries.

Moreover, navigating foreign investment landscapes is essential. Familiarity with the regulations of the Securities Exchange Commission in the U.S., or equivalent bodies abroad, ensures compliance and prevents costly missteps.

Scaling and Adapting Business Models for Global Growth

As a startup stages its global entry, adapting the business model to cater to diverse customer bases is indispensable. Research from the Global Startup Ecosystem Report reveals that startups that can iterate their products or services to meet the distinct preferences of varied markets often achieve more sustainable growth.

The rise of machine learning and A.I. technologies allows startups to analyze global market trends and customer preferences in real time. This intelligence can inform decisions on whether to pivot the approach for a product service or to remain firm in the offering while innovating on the delivery or operations front.

Real-World Success Stories

Real estate startups that leverage Google Cloud to analyze global housing trends, or financial services startups that use machine learning to understand diverse market needs, exemplify how tech can potentiate a startup's global strategy. A case in point involves Canadian startups branching into AI and machine learning to customize their product service for an international audience, diversifying their revenue streams and increasing their resilience to market fluctuations.

Additionally, Israel's startup ecosystem, known for its robust innovation in tech, has seen numerous companies blossom on the global stage by exporting their technology and business model—showing that strategic application of tech can indeed elevate a startup's global prospects.

Emerging Trends: Sustainability and Social Entrepreneurship in the Startup Sphere

Green Ventures: The Rise of Eco-Conscious Startups

Today's entrepreneurs are not just chasing profits; they're pursuing purpose. Industry experts like John Elkington, author of the seminal book 'Cannibals with Forks: The Triple Bottom Line of 21st Century Business', advocate for sustainable business models. And it’s catching on: recent figures suggest that nearly 60% of consumers are willing to change their shopping habits to reduce environmental impact.

An increasing number of startups are embedding sustainability into their business models from the get-go. For instance, the success of the electric vehicle company Tesla has sparked a flurry of green investments, showing a clear consumer and investor interest in sustainability-focused products and services.

Impact Investing: Fueling Startups for Good

Investors are playing a pivotal role in encouraging startups to turn to social entrepreneurship. The Global Impact Investing Network reports billions of dollars flowing into impact investments, with exceptional growth forecasted. These ventures range from renewable energy platforms to financial services geared towards underserved communities. It signifies a paradigm shift where venture capital is mingling with values-driven business initiatives, aligning financial muscle with global betterment.

AI and Ethics: A New Frontier for Innovative Startups

In the tech sector, a wave of startups is rising, marrying artificial intelligence with ethical guidelines. Leaders like Sundar Pichai, CEO of Google, have emphasized the importance of responsible AI, indicating a burgeoning trend in the responsible tech domain. Machine learning algorithms, when designed with fairness and transparency, can become powerful tools for tackling societal challenges while offering immense business opportunities.

Social Footprint: A Metric for Modern Startups

Just as important as the technological advancements startups bring to the table, is the social impact they have. Consumers are increasingly prioritizing companies that contribute positively to the world. As a result, criteria such as the Social Return on Investment (SROI) are gaining traction, challenging founders to quantify and communicate the social value they create beyond their financial returns. This measure not only attracts discerning customers but also resonates with a new breed of purpose-driven employees, central to any startup's growth journey.

Building Sustainable Communities Beyond Borders

With the world more connected than ever, startups are also redefining the concept of community. The drive for social entrepreneurship has gone global, with companies like Kiva pioneering platforms that bridge lenders to entrepreneurs in developing regions. This trend emphasizes the vital role startups play in fostering inclusivity and underscoring the fact that financial success and social impact are not mutually exclusive.

The tide is clear: as emerging startups leverage tech to supercharge growth, a conscious effort to integrate social and environmental stewardship will define the leaders of tomorrow. Entrepreneurs worldwide are not just creating products; they're crafting ecosystems that reflect a robust commitment to sustainability and social responsibility.