The Bedrock of Business: Understanding Pricing Fundamentals

Unlocking the Vault of Pricing Mastery

At the heart of every business's operation is the craft of setting prices. A strategic approach to pricing isn't just about numbers; it's a complex dance between cost, value, and customer perception. Successful businesses understand that pricing isn't a static element but a dynamic tool that directly impacts sales, profitability, and market positioning. Harnessing the synergy of cross-functional teams is essential in strategizing an effective pricing policy that aligns with business objectives. Meticulously analyzing the cost structure and consumer behavior is crucial in formulating a pricing strategy that works.

Price to Value Equation

While it may seem straightforward, many businesses fall into the trap of setting prices without a proper grasp of the market conditions and cost implications. It's not just about marking up costs to determine a final price; it's about understanding the value customers place on your product or service. Consider Apple, a titan in the technology sphere, that has consistently leveraged a premium pricing strategy to position its products as top-tier must-haves. This approach not only reflects the quality and innovation associated with its products but also builds on the brand's prestige.

The Psychology of a Price Tag

Although often overlooked, psychological factors significantly influence customer purchasing decisions. Shifting from even pricing to charm pricing (like $9.99 instead of $10) has proven to compel consumers, as studies show that customers perceive odd prices to be significantly lower than they are. This simple yet effective technique can be the nudge that increases sales and customer throughput.

Gauging the Market Pulse

Market-oriented pricing strategies reflect the intent of a business to align its prices with perceived market rates. For example, companies such as Walmart and Costco operate on a cost leadership model, setting prices that are compellingly low to drive high volume sales. This approach draws in price-sensitive customers and establishes the brand as a cost-effective option. Conversely, luxury brands like Rolls-Royce adopt a pricing model that implicitly signals high quality and exclusivity, appealing to an entirely different customer segment.

Embracing the Evolution of Pricing

Business landscapes are constantly evolving, necessitating agile pricing strategies. One can look to Netflix's dynamic shift from DVD rentals to a subscription-based streaming service to understand the importance of adaptive pricing models. The ability to modify prices in response to market changes, competitive actions, or cost fluctuations is fundamental to maintaining a competitive edge and safeguarding business revenue streams.

Psychological Pricing: The Mind Games That Boost Sales

Deciphering the Art of Mindful Pricing

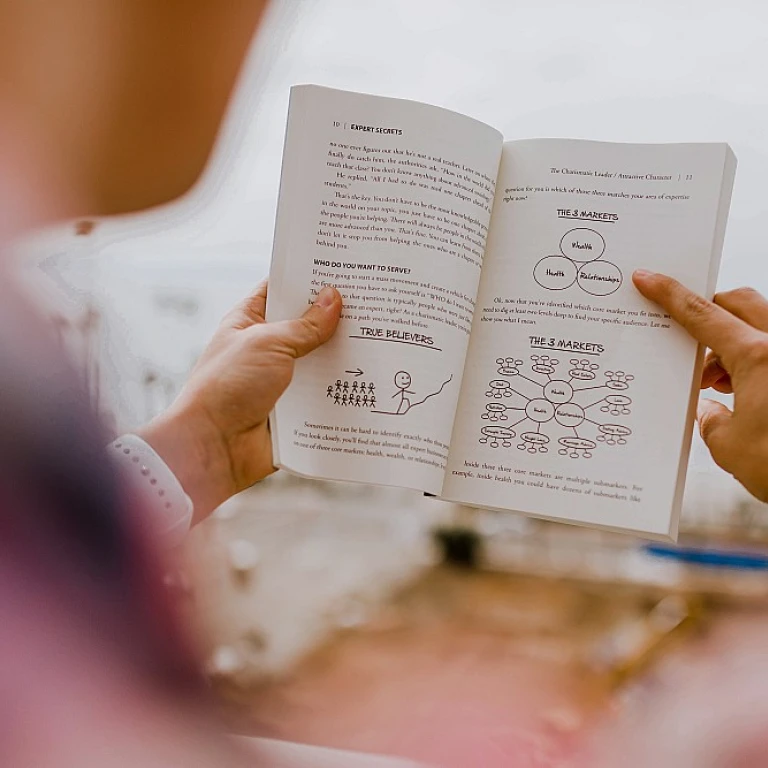

↵↵Every purchase decision is a complex dance of logic and emotion, and savvy companies know how to lead. To truly ignite sales and etch a brand into the public mind, businesses are turning to psychological pricing — a strategy that's as much about understanding human psychology as it is about the numbers themselves.↵↵Take, for instance, the charm of the number nine. Studies have consistently shown that products priced at, say, $19.99, often have stronger sales compared to those priced a dollar higher. It's a psychological trick; we're drawn to the leftmost digit, making us perceive the price as closer to $19 rather than $20. This is referred to as 'left-digit effect' and is a cornerstone of psychological pricing.↵↵Furthermore, embracing psychological pricing means recognizing the power of perception. For example, research reveals that consumers tend to associate higher prices with higher quality. Rolls-Royce, a brand synonymous with luxury, leverages premium pricing to maintain an image of exclusivity and superior quality. Meanwhile, brands like Walmart implement cost leadership strategies. By offering 'everyday low prices', they are not just competing on cost but are also creating a perception of value that appeals to cost-conscious customers.↵↵The Anchors that Guide Buyer's Choices

↵↵Pricing acts as an anchor in the customer's mind, setting expectations for your product or service. Dynamic pricing, a strategy that allows businesses to adjust prices on-the-fly based on market demand, leverages this to great effect. Ride-sharing giant Uber, for example, uses dynamic pricing to balance supply and demand, ensuring that customers have access to rides when they need them most — even though it sometimes means higher prices during peak hours.↵↵Adopting a dynamic pricing strategy isn't without its challenges, as it requires constant market vigilance and a robust technological infrastructure. However, the prowess of tailoring your pricing in real-time to the pulse of the market can lead to maximized revenue and customer satisfaction. It's a delicate balance, but when done right, it can enhance profitability and service availability.↵↵The Finer Points of Segment-Specific Pricing

↵↵Splitting hairs over segments may seem like overkill, but in the arena of psychological pricing, it's where businesses can strike gold. By adjusting prices for different market segments, a business can target customers more effectively. Netflix's tiered subscription model is a masterclass in segment-specific pricing. By offering basic, standard, and premium plans, they address varying consumer needs and perceived value, allowing them to cater to a broader market without alienating price-sensitive viewers.↵↵This tiered approach acknowledges that not all customers are created equal and that personalization can drive sales. It taps into the consumer's desire for choice and control, enhancing their purchasing journey and, effectively, the company's bottom line.↵↵Segment-specific pricing also finds its appeal in business-to-business transactions. Software and service providers often extend customized pricing based on the size of a client's organization, usage, or the breadth of services required. It's a testament to the fact that psychological pricing isn't solely about the individual consumer but is an effective weapon in the broader context of market stratification.↵↵By weaving psychological nuance into pricing strategies, businesses can not only catalyze growth but can also engineer brand loyalty. After all, a price isn't just a figure; it's a signal, a message, and a potent tool in the marketplace's ongoing narrative. As we explore other pricing strategies in the subsequent sections, remember that whether it's the simplicity of cost-plus pricing or the nuanced tug-of-war in competitive pricing, the heartbeat of pricing strategy lies in its ability to speak to the customer — mind, wallet, and soul..Dynamic Pricing in Action: Flexibility Meets Market Demand

The Merits and Mechanics of Dynamic Pricing

Dynamic pricing, a strategy sophisticated in its adaptability, hinges on the flexibility to adjust prices based on real-time market demands and consumer behavior. Far from a static approach, this strategy requires a keen analysis of market trends, a pulse on competitor movements, and a robust technological backing. Consider major players like Uber, who ramp up fares during peak hours through surge pricing. Or airlines, which frequently adjust ticket prices based on demand and timing.

A study by the National Bureau of Economic Research illustrates how dynamic pricing can increase revenue by allowing businesses to capture consumer surplus through frequent price adjustments. The report cites examples where dynamic pricing has led to a 10% rise in profit margins for companies that have effectively implemented the approach.

But beyond increasing profit margins, this fluid pricing model ensures businesses remain competitive and relevant in an aggressive marketplace. Tesla, for instance, has dynamically adjusted the cost of its vehicles and Autopilot features in response to market conditions and inventory levels.

Gauging Impact with Real-Time Data

Gathering real-time analytics sits at the heart of a successful dynamic pricing strategy. Real-world use cases highlight this: Amazon reportedly changes prices on its products every 10 minutes, using algorithms that analyze competitors' pricing, supply, and demand. Furthermore, a labor innovation strategy can further refine pricing by leveraging workforce trends and costs.

The dataset for crafting an effective dynamic pricing model could include current sales data, historical prices, consumer purchasing behavior, inventory levels, and competitor pricing. By embedding these inputs into predictive analytics models, businesses can craft prices that oscillate in tune with the market's heartbeat.

Striking the Balance Between Profit and Perception

However, a dynamic pricing strategy is not without its challenges. The balance between maximizing profit and maintaining customer goodwill is delicate. There's a fine line—customers may turn away if they perceive pricing as too volatile or unfair. Case in point, seasonal price hikes by hotels or holiday resorts are accepted by customers due to the increased demand during peak times, but arbitrary price changes can lead to customer dissatisfaction and brand erosion.

Companies like Rolls Royce have overcome potential backlashes by embedding service agreements and warranties into their pricing strategies, thereby softening the perception of price hikes. In the entertainment sector, dynamic pricing can take the form of early bird discounts, enhancing customer goodwill while also managing demand.

Reports by Forbes Business Council and other industry think-tanks often discuss the importance of transparent communication with customers when employing dynamic pricing. A clear rationale for price changes can mitigate customer concerns and help retain loyalty.

Conclusion

In conclusion, while dynamic pricing offers an agile path to maximize revenue, businesses must navigate the strategy with customer sensitivity in mind. The right blend of data analytics and customer relationship management can position businesses to effectively harness dynamic pricing, making it a potent tool in the arsenal of modern pricing strategies.

Digging into Cost-Plus Pricing: A Simple Yet Effective Strategy

The Essentials of Cost-Plus Pricing

Peeling back the layers of pricing strategies reveals the straightforward approach of cost-plus pricing, a method that centers on simplicity. At its core, this technique involves calculating the total costs of producing a product or service, adding a markup percentage for profit, and voila, you've set your price. It's a method as old as trade itself and fabled for its transparency and ease of understanding. Think of it as the bread and butter of pricing, where the ingredients are clear and the outcome is expectedly satisfying.

Calculating for Confidence

In a market where uncertainty often reigns, cost-plus pricing hands businesses a lifeline of predictability. By knowing your costs, you can confidently set prices that cover expenses and ensure a healthy profit margin. This is not just a thumb in the air; it's about precision. Setting the right markup involves understanding industry standards and market tolerance. For example, retail typically sees a markup of 50%, while other industries may vary significantly.

Case Study: The Reliability in Retail

Take for example major retailers like Walmart. With a vast array of products and a keen eye on cost control, they employ this strategy to consistently offer customers value while maintaining their profit goals. This balance is a testament to the importance of a well-executed cost-plus pricing strategy.

Advantages: Clarity and Simplicity

The beauty of cost-plus pricing lies in its straightforwardness. It's not just easy to explain to customers, it's also simple for teams to implement. It makes setting prices almost routine, and for new businesses grappling with myriad startup challenges, it can provide a clear guidepost.

Considerations: Market Sensitivity and Value Perception

Yet, it's not without its critics. Some argue that this strategy ignores the complexities of market dynamics and customer value perception. If your competitors embark on a feature war or a race to the bottom with competitive pricing, being tethered to costs might leave your pricing strategy outpaced and your products undervalued or overpriced in consumers' eyes.

The Ongoing Dance with Costs and Pricing

A business must keep an eagle eye on fluctuating costs to maintain its profit margin through the cost-plus approach. An uptick in raw materials or labor costs could mean a necessary bump in prices, leading to a delicate tightrope walk with customer retention as the wind gusts.

Cost-Plus Pricing in Modern Times

In today's ever-evolving market, is cost-plus pricing still relevant? Absolutely. For instance, businesses that deliver high-quality, niche products or services often turn to this model to underscore the craftsmanship and labor that goes into their offerings. And for commoditized items where competition is fierce and differentiation is marginal, it can be a bulwark against price wars, giving businesses a modicum of control in chaotic waters.

Embracing the Hybrid Approach

Sophisticated businesses sometimes jazz up the traditional method by integrating elements of value-based or dynamic pricing for a more holistic approach. This doesn't just add a dash of modernity—it ensures revenue isn't left on the table in a market that's increasingly personalized and segmented.

Deciphering the Right Markup for Your Business

When it comes down to deciding just how much 'plus' to add, businesses must look in the mirror and ask, 'How much is our service really worth to our customers?' It's not merely a case of slapping on a standardized markup—it's about understanding your value proposition and how it stands out from the competitive landscape.

Concrete as it may seem, there's an art to cost-plus pricing. It's about assembling a collage of costs, market wisdom, and a finger on the pulse of your customers. Get it right, and your pricing strategy could be your ticket to a sustainable and profitable business, charming your customers with its honesty and simplicity.

The Risks and Rewards of Competitive Pricing Tactics

Unveiling the Intricacies of Competitive Pricing

Have you ever wondered how businesses manage to set prices that attract customers while outmaneuvering their rivals? Competitive pricing, a cornerstone of market-based pricing strategies, is a balancing act of setting prices based on the offerings of competitors. Unlike cost-plus pricing, which adds a standard markup on costs, a competitive strategy is more dynamic and requires a deep dive into the market's pricing landscape.

Expert Insights: How Competitive Pricing Fuels the Market

Renowned business consultants highlight that competitive pricing isn't only about setting lower prices. Instead, it involves understanding consumer behavior and the value perception of your products in comparison to your competitors. Forbes Business Council members have often emphasized the importance of sophisticated analysis tools to monitor competitor prices, ensuring businesses remain relevant. This strategy, when paired with strong branding and customer service, could increase market share even if you're not offering the lowest price on the market.

Case Studies: When Competitive Pricing Strategies Soar

Consider Amazon, a global retail giant, known for its ability to adjust prices on millions of products in real-time, responding to competition. This tactic ensures their products are priced competitively, often leading to increased sales and customer loyalty. Companies like Walmart and Costco also succeed with a competitive pricing strategy by offering a price matching guarantee, reassuring customers that they're getting the best possible deal.

Navigating the Risks: A Balanced Approach

However, there's a fine line between competitive pricing and price wars, which can erode profit margins. Tesla showcases a strategic approach, differentiating their products on innovation and quality rather than engaging in price wars. Moreover, businesses must consider the operational costs and ensure they are not undercutting themselves. It is crucial to weigh the revenue benefits against the potential decrease in profit margins.

Psychological Pricing: A Subtle Tactical Edge

Psychological pricing can complement competitive pricing strategies effectively. By understanding the psychology of pricing, one can enhance the customer's perception of value. For example, a $299 price point often feels substantially less than $300, even though the difference is minimal. This strategy, known as 'charm pricing', can play a significant role in consumer decision-making.

Customizing the Competitive Edge

Each industry has unique demands, and consequently, the approach to competitive pricing should be tailored accordingly. In the service sector, businesses often package services together, as seen with bundle pricing in telecom offerings. For luxury brands like Rolls-Royce, competitive pricing might entail maintaining a high price point to emphasize exclusivity and quality.

Reaping Long-Term Rewards with Smart Pricing

A successful pricing strategy involves constant monitoring and adapting. By analyzing the market trends and remaining agile, businesses can pivot their strategies to suit evolving market conditions. This ensures long-term sustainability and can build a brand that customers trust for its fairness in pricing, ultimately leading to enhanced customer loyalty and brand reputation.

Premium Pricing: Crafting Exclusivity for Maximum Margins

The Allure of Premium: Upscale Pricing for Upscale Products

When businesses aim to communicate quality and exclusivity, they often turn to premium pricing strategy. This approach involves setting prices higher than the competitors', creating a perception of superior value. Notoriously successful with brands such as Apple and Rolls-Royce, premium pricing isn't just a tactic; it's a statement.

Finding the Sweet Spot: Balancing Cost and Perceived Value

Conventional wisdom might suggest that higher prices deter customers, but that's not the entire story. Consumers often equate price with quality. A report by Forbes Business Council illuminates how premium prices can lead to a higher profit margin. Still, the art lies in finding that pricing sweet spot where perceived value balances out the cost.

Case in Point: Apple's Market Mastery

Consider Apple's pricing prowess. By offering products with innovative features and a sleek design, accompanied by a branding strategy that screams luxury, Apple continues to secure its place in the premium segment effectively. According to a U.S.-based study, Apple's pricing strategy not only garners hefty margins but also fosters a loyal customer base willing to pay top dollar for the latest devices.

Strategies Beyond Electronics

Premium pricing isn't confined to technology; it thrives across various markets. Luxury car manufacturer Rolls-Royce, for example, sets staggering prices underscored by bespoke craftsmanship and exclusivity, driving home the message that their vehicles are more than just a mode of transport—they're symbols of status.

Psychological Underpinnings and Customer Reaction

Digging deeper into the psyche, psychological pricing, a topic explored earlier, also plays a substantial role in the premium market. Psychological techniques, like setting prices just below a whole number, may seem trivial but can dramatically alter a customer's perception and willingness to buy.

When Premium Pricing Backfires: The Cautionary Tales

Yet, this strategy is not without its pitfalls. If the quality doesn't match the price point, or if the market shifts, companies can be left justifying their prices. The luxury phone maker Vertu, which banked on the premium strategy, faltered because it couldn't align cost with consumer-perceived value amidst fast-paced technological advancements.

Emerging Trends: The Shift to Services

Furthermore, premium pricing strategies are evolving with the times. Amazon has dabbled in this through its Prime service—beyond just shipping, Prime creates a sense of an exclusive club with a variety of benefits, proving that premium pricing can extend beyond products to services.

Implementing Premium Pricing: A Calibration of Features and Prestige

For businesses considering premium pricing, it's critical to ensure that features and prestige justify the cost. As Samsung and other electronics giants have shown, adding innovative features can validate higher price points, consequently influencing the customer's decision-making process. It's not just about a superior product or service; it's about crafting an image that resonates with being the best, offering an unrivaled experience.

Premium Lessons for Business Strategy

Every pricing strategy business adopts sends a message to the market. Premium pricing goes beyond recouping costs or keeping up with competitors. It is a deliberate choice to position a brand at the pinnacle of the market, shaping customer expectations and defining the brand's essence. From the allure of Rolls-Royce's exclusivity to the pride of owning the latest Apple innovation, premium pricing remains a complex yet rewarding strategy that, when executed well, can lead to unparalleled success.

Discount Strategies: The Lure of Offers in Customer Acquisition

Maximizing Impact with Strategic Discount Offerings

Discount strategies can be a magnet for new customers, creating a buzz that draws in bargain hunters and cost-conscious consumers alike. Yet, it's not just about slapping a sale sign on products. Smart businesses use strategic discounting to enhance customer acquisition without eroding brand value or profit margins.

Bundle Pricing: Multiplying Value While Moving Inventory

By packaging multiple products or services together at a reduced rate, businesses can sway customers to perceive higher value. This approach not only increases sales volume but also introduces buyers to a broader range of offerings, possibly increasing customer lifetime value. Take Costco, for instance, where bundle pricing is virtually synonymous with value – members walk out with carts filled, evidence of a strategy that works. A study published in the Journal of Marketing Research suggests bundle pricing can increase consumers' perceived savings, which is a psychological driver that can lead to higher sales.

Penetration Pricing: Capturing Market Share Swiftly

The launch of a service or product might be paired with penetration pricing, setting prices low to gain market share quickly. This can be particularly effective in markets like India or Australia, where cost sensitivity is a significant factor for a large portion of the population. Over time, as the customer base grows, prices gradually rise. An example of this was Amazon's initial strategy with the Kindle or Netflix's regional pricing models, which tailored introductory rates in new markets.

Loss Leader Pricing: The Trade-Off Between Losses and Gains

Big players like Walmart and Amazon often employ loss leader pricing to entice customers to their ecosystem. They'll take a hit on certain products but recover costs through additional purchases. A classic case? Printers sold at a loss while ink cartridges drive profitability. Yet, this strategy isn't without dissent – small businesses argue it undercuts them unfairly, sparking controversies around antitrust laws in regions like California.

The Psychological Edge of Limited-Time Offers

Limited-time offers create urgency. As the clock ticks, customers are more likely to act quickly to snag a deal, driving immediate sales boosts. Psychological pricing research has consistently shown that time-limited sales can create a fear of missing out or FOMO effect, pushing consumers towards faster purchasing decisions.

Pricing for Perceived Scarcity

Scarcity pricing, similar to what high-end brands like Rolls-Royce utilize, can also cross paths with discount strategies. Limited availability sales, like those legendary 'Keystone Events,' can incite a rush of buying activity. The allure? Owning something exclusive.

Innovative Pricing Models Shaping the Future of Business

Trailblazing Pricing Structures Tailored for Tomorrow

As businesses evolve in tandem with technological advancements and consumer behavior, pricing structures too must undergo innovation. Companies no longer rely solely on traditional methods; instead, they pave the way with innovative pricing models that redefine value exchange. This wave of progress transforms how we value products and services while maximizing revenue.

Subscription-Based Success Stories

One model resonating across industries is the subscription-based approach. Giants like Netflix and Amazon have shown impressive growth by shifting to services that guarantee consistent revenue through recurring payments. Subscriptions promise predictability for both businesses and customers, aligning costs with usage and nurturing customer loyalty.

Freemium Models Fueling Viral Growth

The freemium model offers basic services at no cost while reserving advanced features for paying customers. This model captivates users by delivering immediate value at no initial cost, a strategy that propelled brands like Dropbox and Spotify to widespread adoption. By carefully balancing the features between the free and premium tiers, businesses leverage freemium strategies to scale rapidly and convert free users into paying customers over time.

Value-Based Pricing: Consumers at the Core

Moving away from the cost-centric approaches, value-based pricing strategies place the customer's perceived value at the forefront. This game-changing perspective requires an acute understanding of market demand and a clear insight into the unique benefits the product or service provides. Companies like Rolls-Royce have mastered this with their 'Power by the Hour' approach, aligning their pricing with the value delivered, not just the cost of production.

Unpacking Usage-Based Models

Advancements in technology have also enabled usage-based pricing models, akin to how utility companies charge for water or electricity. Uber’s per-mile and per-minute pricing, for example, has disrupted traditional taxi service pricing by closely matching price with actual use, providing transparency and control for the user.

The Advent of Outcome-Based Pricing

Outcome-based pricing takes the concept of aligning price with the value received to the next level. Here, the price is directly linked to the success metrics of the service or product—for instance, pharmaceutical companies linking medication pricing to patient health outcomes. This forward-thinking strategy necessitates robust data tracking and a deep partnership between provider and customer.

Conclusion: Reshaping the Future with Flexible Pricing

In a nimble business environment, innovative pricing models offer the flexibility and adaptability businesses need to stay ahead. Whether it's through subscriptions, freemium offers, value-based or usage-based pricing, these strategies illustrate the diverse possibilities for companies to create mutual value and redefine success in the modern marketplace.