Unpacking Macroeconomic Theories: A Roadmap to Market Understanding

Decoding the Essence of Macroeconomic Theories

At its core, macroeconomics looks beyond individual markets to examine the forest and not the trees. Thought leaders like John Maynard Keynes and Adam Smith laid the foundation for what we today know as the large-scale economic framework guiding market dynamics. In The Wealth of Nations, Smith introduced the concept of the 'invisible hand', driving home the point that free markets regulate themselves by means of competition, supply, and demand.

Keynesian economics, on the other hand, takes a more hands-on approach, emphasizing the role of government intervention during economic downturns. In his landmark book, The General Theory of Employment, Interest, and Money, Keynes challenged the notion that economies could self-regulate back to full employment after shocks. The gross domestic product (GDP), a key economic indicator, reflects the practical application of these theories. It encapsulates the total value of goods and services produced and is often used to gauge the economic performance of a country.

Understanding the dynamics of macroeconomic theory is not just academic. It underpins policy decisions that affect international trade, regulate inflation, and manage unemployment, profoundly impacting the economy at large. During times of crisis, such as the 2008 financial collapse, macroeconomic principles guide central bank policies. They inject liquidity and stabilize markets, underscoring their place at the heart of public and private sector strategies.

Analyzing Governmental Influence in Macroeconomic Health

Government policies are intrinsically tied to macroeconomic stability. Monetary policy, enacted by central banks like the U.S. Federal Reserve, involves managing the money supply and interest rates to influence economic activity. Meanwhile, fiscal policy, dictated by governmental budget determinations, focuses on taxation and spending to encourage market growth or contraction. These tools not only affect the nation's economic climate but have ripple effects on global markets.

Economic indicators such as the unemployment rate, Consumer Price Index (CPI), and Producer Price Index (PPI) deliver a data-backed picture of the economic organ's health. By studying trends and utilizing these economic barometers, governments and businesses can forecast potential market shifts and adjust their strategies accordingly.

Pioneers of Economic Thought: Shaping Modern Markets

Modern economics has been shaped by the insights of remarkable thought leaders. The innovative theories of Karl Marx, which delve into the relationship between labor and capital, still provoke discussion regarding market structure. Similarly, the distinct approach of David Ricardo emphasizes comparative advantage, a theory that supports the notion of nations benefiting from trade by specializing in the production of goods and services they can produce most efficiently.

Exploring the impact of antitrust laws, which stem from a need to regulate the concentration of market power, is another way in which economic theories apply practically. The interplay of regulation, with respect to competition, illustrates tangible applications of economic principles in preserving market dynamics.

As we progress through various facets of economics, from the nuances of microeconomic patterns to the strategic implementation of policies, the depth of macroeconomic theories serves as a roadmap. The subsequent sections will further explore how these principles translate into the daily machinations of markets and the continual evolution of economic practice.

Tracking Economic Indicators: A Snapshot of Financial Health

Economic Measures Reflecting Financial Vitality

Peering into the economy's health is akin to a physician examining vital signs; economic indicators serve this function for financial analysts and economists alike. Consider the data around gross domestic product (GDP), which encapsulates the market value of all finished goods and services produced. U.S. GDP figures from the Bureau of Economic Analysis reveal a complex narrative of growth patterns, consumer spending habits, and investment shifts.

Nurturing an understanding of economics directly influences the strategic blueprint businesses draft to steer through the predatory markets. Parsing these indicators isn't just for economists; it's a vital part of a strategist's toolkit.

Employment Data: The Workforce Gauge

Job creation rates, unemployment numbers, and labor market participation statistics are released regularly by government agencies like the U.S. Department of Labor. In Europe, Eurostat does the honors. These figures are the pulse monitoring the vigor of the economy -- a sudden uptick in unemployment can suggest a downturn, whereas a steady increase in job creation might signal an upswing.

Inflation and Interest Rates: The Balancing Act

Inflation rates and interest rate decisions by central banks such as the Federal Reserve (Fed) or the European Central Bank (ECB) are critical insights for market predictions. If the Fed adjusts interest rates upward, this often aims to temper inflation and cool an overheated economy, a move that responds to a complex dance of supply demand dynamics.

Manufacturing and Service Sector Health

The Institute for Supply Management (ISM) Manufacturing Index provides a sense of the manufacturing sector's health, whereas service sector activity is mirrored by its Non-Manufacturing Index. Fluctuations here can reverberate through the economy, impacting everything from global trade to stock market sentiments.

Consumer Confidence and Retail Sales

Consumer confidence indices, like those from The Conference Board in the U.S., illuminate the optimism or pessimism consumers feel about their economic prospects -- often a harbinger of retail spending. Retail sales data quantify this sentiment, painting a picture of economic vitality, or lack thereof, in consumer markets.

Trade Metrics and International Exchanges

Trade deficits, surpluses, and the terms of trade between nations offer a tableau of international economic relationships. The interplay of exports and imports reflects the country's competitive edge in producing goods and services that the world values.

Microeconomic Musings: Deciphering Price Movements and Demand Curves

Demystifying the Essence of Supply and Demand

At the heart of any economy lie the twin concepts of supply and demand. One might say supply and demand is the DNA of the marketplace, encoding the necessary information for the survival and adaptation of businesses. To unwrap the complexities of market dynamics, it's crucial to first understand how price movements are dictated by the intricate dance between what's available and what's desired.

Understanding Consumer Behavior: The Backbone of Economic Demand

Economics isn't just about cold, hard numbers; it's a study of human behavior and choices. When individuals decide to part with their money in exchange for goods or services, they're vocalizing their needs and preferences. Identifying patterns in consumption can allow economists to predict demand fluctuations with impressive accuracy. Research from Ricardo Perez-Truglia shows how economic theory can be applied to understand and anticipate consumer spending habits.

Decoding the Signals of Price

Price changes can seem mystifying at first glance. However, when you delve into the data, a clearly marked trail can be found. Prices are much more than arbitrary figures; they are signals. They communicate scarcity, value, and can even sway the production strategies of businesses. The Bureau of Economic Analysis provides vital data that shed light on how prices can indicate economic health or turmoil.

The Supply Side: Reading Between the Production Lines

On the flip side of the economic coin is supply—the pillar that supports our society's consumption habits. Production levels, resource allocation, and manufacturing efficiency all feed into the supply narrative. Reports from the Department of Economics at universities such as Princeton offer rich insights into how various industries respond to changes in demand, resource availability, and economic policies.

Real-World Applications: Gleaning Insights from Data

Take, for example, the case of Brazil's açaí berry market. A study published in the American Economic Review analyzed the impact of sudden international demand for this once locally-consumed commodity. It highlights how local producers and the broader economy had to adapt rapidly to global market pressures, influencing not just prices but the social and economic structure of the regions involved.

Bringing It All Together: Supply and Demand in Motion

The equilibrium of supply and demand is ever-changing and reached only momentarily—if at all. It's a delicate balance where economic theory meets the pavement of real-world situations. Understanding this equilibrium is akin to having the playbook for market strategy, giving businesses, investors, and policy-makers a critical edge in a competitive environment. As students and enthusiasts of economics read and digest these principles, they develop a keener sense of how to both interpret and influence market movements.

Policy Insights: Connecting Economic Theory to Public Strategy

Deciphering the Bond Between Economics and Policymaking

When we peel back the layers of the market and its complex mechanisms, we arrive at the heart where economics and public policy beat in unison. Here, the abstract notions of economic theory take on concrete form in strategic policymaking, impacting everything from the availability of resources to the financial well-being of a nation.

Peeking Behind the Curtain of Monetary and Fiscal Policy

Central banks and government treasuries are where macroeconomic theories transcend academia and influence real lives. Take, for example, the Federal Reserve's approach to inflation control through interest rate adjustments, a maneuver aimed at stabilizing purchasing power and curbing excessive economic overheating. Meanwhile, fiscal policy, with its tax levers and government spending, aims to steer the economy towards sustained growth. As economist John Maynard Keynes championed, adjusting these levers can potentially smooth out the rough edges of business cycles.

Evaluating the Effectiveness of Economic Interventions

Reports from institutions like the Bureau of Economic Analysis provide a dashboard of indicators for scrutinizing the outcomes of policy decisions. Scholars from the Department of Economics across leading universities frequently delve into these reports, mining for insights on policy efficiency. The dialogue between economic indicators and policy implications is nuanced, often leading to heated debates within the American Economic Association and beyond, as researchers like Ricardo Perez-Truglia probe into the policy impacts on socio-economic dynamics.

Modeling Economic Scenarios to Illuminate Policy Paths

Informed policy requires a deep dive into economic modeling, a technique that allows policymakers to preview the potential ripples of their decisions. Models bring to life abstract concepts like market failure and economic growth, serving as valuable tools in the economist's kit. As the Princeton-led National Academy of Sciences reports, scenario planning provides a framework to anticipate the outcomes of different policy options, thereby strategizing more effectively for long-term economic resilience.

Navigating Global Economics Through Local Policy Lenses

From the bustling markets of Europe to the dynamic economies of Brazil, local policies reflect unique economic realities. Yet, the grand theories of thinkers like Adam Smith and Karl Marx still echo in the corridors of today's economic policymaking. Case studies from diverse economies reveal just how local policy nuances can ripple into global economic shifts, impacting everything from gross domestic product to the economic well-being of communities.

Conclusion

By studying the interplay between economic theories and pragmatic policy strategies, we gain a richer, multidimensional understanding of market dynamics. Whether we're tracking the latest economic indicators or dissecting the implications of a policy shift, the goal remains the same: to steer the economy towards a balance of growth, stability, and equity. The pursuit of this balance is no mean feat, but it's the lifeblood that fuels every thriving market.

Case Studies in Economic Growth: Lessons from Global Leaders

Understanding Economic Success Through Global Examples

The march of economies across the globe can be a telling metric for understanding the multifarious concepts we've unpacked about macroeconomics and financial indicators. When we study nations that have led the pack in terms of economic growth, patterns start to emerge, knitting theories with reality.

Breaking Down the Growth of Asian Tigers

In the annals of economic success stories, the rapid growth of the Asian Tigers (Hong Kong, Singapore, South Korea, and Taiwan) stands out. These countries mastered elements of macroeconomics, creating a fertile environment for industries to flourish from the 1960s through the 1990s. Their collective emphasis on education, innovation, and export-oriented policies led to sustained growth, turning them into high-income economies. Experts like Paul Krugman have pointed out that while these nations heavily invested in human capital, their economic expansion was also characterized by a significant increase in inputs - both labor and capital - rather than just improvements in efficiency.

Learning from Scandinavian Economic Models

On a different note, the Scandinavian countries, specifically Denmark, Norway, and Sweden, offer invaluable case studies in balancing economic prosperity with social welfare. Economists have extensively studied how these nations manage to uphold high standards of living, low levels of inequality, and superior educational outcomes. Their economic model hinges on the principles of an open economy, extensive government services, high tax rates, and strong labor unions. By revealing the mechanics behind their mixed-market economies, we gain insights into how consistent policy adjustments aligning with economic theory can yield robust results.

Analyzing the Economic Powerhouse of the United States

The United States' economy, fueled by innovation and entrepreneurship, serves as an ever-evolving case study of a mixed economy. Emphasizing a strong service sector, the power of consumer spending, and the role of technological advances, the U.S. economy continuously adapts to market signals and policy changes. Its economic trajectory often influences global economic trends and strategies, underscoring the significant role of macroeconomic policy crafting.

Emerging Market Resilience: India and Brazil

Emerging markets such as India and Brazil demonstrate the impact of macroeconomic management on economic growth. India, with its focus on service and information technology sectors, and Brazil, with its rich natural resources, have faced their share of policy challenges. Nonetheless, their strides in reforming their markets, increasing trade openness, and harnessing demographic dividends spotlight critical lessons in fostering economic resilience amidst global volatility.

Tying it Back to Theory

By scrutinizing these varied examples, what becomes clear is that there is no one-size-fits-all approach to economic growth. As we've seen, demand and microeconomic factors work hand in hand with public policy and macroeconomic strategies to shape the unique paths these nations have trodden. It reiterates the intricate ballet of market forces and governmental interventions, a tune to which economists and policymakers must choreograph their steps with precision.

The Interplay of Economics and Finance: Navigating Capital Markets

The Vital Connection Between Economics and Capital Markets

When we peel back the layers of economics and finance, we find a complex narrative that ties the fortunes of individuals, companies, and nations to the rhythmic pulsations of capital markets. Resource allocation, risk assessment, and investment are not just theoretical concepts; they represent the very mechanisms that fuel the engine of economic growth and development.

Expert Perspectives on Market Movement

Financial experts like Burton Malkiel and Eugene Fama have famously dissected market behaviors and efficiencies, informing our understanding of price reactions to economic changes. The efficient market hypothesis, for instance, proposes that prices in capital markets instantaneously reflect all known information, challenging the notion of 'beating the market' through skill or luck.

The Role of Central Banks in Market Stabilization

Central banks across the globe, such as the Federal Reserve in the U.S. or the European Central Bank in Europe, maneuver through the delicate task of regulating the money supply to promote stable markets. Profoundly influential in the economic narrative, their policies directly impact interest rates and have ripple effects on financing and investment decisions across economies.

Dissecting the GDP: A Measure Beyond Numbers

Understanding the Gross Domestic Product (GDP) tells a story far richer than its numerical value. It encapsulates the total economic output, embodying the production distribution and consumption of goods and services. Economists at the Bureau of Economic Analysis meticulously compile these figures to gauge the health and pace of economic growth.

Financial Instruments: The Protagonists of The Economic Stage

Within the theater of economics, various financial instruments like stocks, bonds, and derivatives play leading roles. These tools not only allow investors to diversify and manage risk but also serve as critical elements in transferring resources from surplus units to those with productive investment opportunities, thus fostering economic development.

Case Studies: Yielding Prudent Economic Insights

Reflections on past economic events, such as the 2008 financial crisis, offer invaluable insights into the intersection of economics and finance. The intricate interplay between lax regulatory environments, reckless lending practices, and the subsequent market turmoil underscores the importance of prudent economic and financial analysis.

Contemporary Issues: Exploring Market Failures and Economic Controversies

Understanding Market Failures Through a Magnifying Glass

Market failures often serve as a fascinating microcosm, revealing the friction points within an economic system grappling to allocate resources efficiently. A prominent example of market failure lies in externalities, as seen in environmental economics. A study by the U.S. National Academy of Sciences outlines the substantial costs environmental externalities impose on society -- not reflected in the market price of goods, indicating a divergence between private and societal costs.

Dissecting Economic Controversies

Debate is at the core of economics, with controversies often igniting discourse on policy effectiveness. For instance, the Keynesian versus Classical economics debate persists, with differing views on government intervention. Economists like Paul Krugman of the American Economic Review argue for active fiscal policy as a counterbalance during economic downturns, while others suggest that market self-correction is more efficient.

Case Studies in Managing Economic Disruptions

In recent years, several case studies have brought to light the importance of agility in the face of economic disruptions. The Eurozone crisis, detailed in reports from the International Monetary Fund, showcases how currency union problems can escalate into profound market dysfunctions. These studies underscore the intricate relationship between fiscal policy and economic stability.

Parsing the Complexities of Systemic Risk

One cannot explore market failures without considering the systemic risks that led to the 2008 financial crisis. A blend of economic theory and finance, the Federal Reserve's analyses on 'too big to fail' institutions highlight the potential for domino effects within interconnected economies. Further research on this topic might inform strategies to mitigate similar crises in the future.

Preparing for the Future: Economics Education for Budding Economists

Educating the Next Generation of Economists

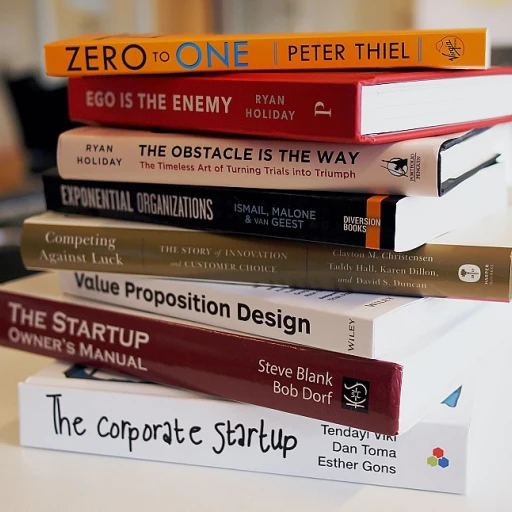

As we explore the fabric of economics that weaves through various aspects of society, we recognize the crucial role that education plays in shaping future leaders in this sphere. The journey for budding economists begins with a robust grounding in both macroeconomics and microeconomics, the twin pillars that support a comprehensive understanding of the economic world. Educators and institutions across the globe are tasked with not only imparting knowledge but also igniting a passion for continuous learning in this ever-evolving field.

Immersing Students in Real-World Economics

While academic theories serve as the backbone of economic education, it's the application of these theories to real-world scenarios that truly prepares students for the complexities of market dynamics. Through case studies derived from recent economic growth patterns and political economy challenges, students can contextualize and apply their learning effectively.

For example, the American Economic Association (AEA) provides resources highlighting pivotal economic research that can help students relate textbook concepts to tangible situations. Reports from the Bureau of Economic Analysis (BEA) and findings from the National Academy of Sciences further supplement coursework with empirical data and insights, enriching the educational experience.

Leveraging Technology in Economic Studies

Modern educational tools, including simulations and interactive data sets, are transforming the way economic theory is taught and learned. Students now have access to tools that allow them to visualize the effects of monetary policy changes or market failure scenarios, reinforcing their theoretical knowledge with practical experimentation.

Renowned economists like Ricardo Perez-Truglia have utilized novel experimental methods to make complex economic concepts more accessible to students. His work exemplifies the innovative approach required to train adaptive thinkers prepared to tackle finance and market challenges.

Collaboration between Academia and Industry

Connections between academic institutions and industry practitioners enhance the learning journey for economics students. Collaborations like those between Princeton’s Economics Department and central banks, or the integration of American Economic Review's publications into the classroom, bridge the gap between theory and practice. Exposure to current research and real-time market analysis equips students with insights into the practical application of their studies.

International Perspectives in Economic Curricula

Incorporating global perspectives is also fundamental in preparing students for participation in the interconnected world economy. The inclusion of key historical texts such as Adam Smith's 'Wealth of Nations', or case studies featuring economic transitions in countries like Brazil and regions like Europe, broadens the context of economic study. This approach fosters an awareness of diverse economic systems and policies, better preparing students for international markets and global finance roles.

Conclusion

In a nutshell, the future of economics rests in the hands of those currently buried in textbooks and economic models. The education system has a profound responsibility to not only transfer knowledge but also to instill an aptitude for critical thinking and a desire for lifelong education in the face of a dynamic economic landscape. An effective blend of traditional learning, technological advancements, cross-disciplinary integration, and international scope will ensure that the economics students of today become the thought leaders and innovators of tomorrow.

-large-teaser.webp)