Understanding Rapid Inflation: Key Economic Indicators

Decoding Key Economic Indicators

When we talk about rapid inflation, we’re zeroing in on prices soaring at breakneck speed. It's crucial to grasp the economic indicators that paint the full picture. According to the Bureau of Labor Statistics (BLS), the Consumer Price Index (CPI) saw a spike of 6.2% year-over-year in early 2022. This figure is stark; it reminds us how drastically the costs of goods and services can climb.

CPI: The Go-To Inflation Gauge

The CPI measures the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. This rise is driven by increased demand and limited supply, pushing prices up—a phenomenon known as ‘demand-pull inflation.’ For instance, the inflation rate during the 1970s oil crisis skyrocketed primarily due to cost-push factors.

PCE: Beyond Just CPI

Don’t overlook the Personal Consumption Expenditures (PCE) Price Index, either. The PCE, preferred by the Federal Reserve, considers a broader range of purchases. According to the Bureau of Economic Analysis (BEA), the PCE price index went up by 5.8% over the year 2021. This index covers a vast array of goods, adjusting for changes in consumer behavior over time.

Gauging the Money Supply

But wait, there's more. The money supply, measured as M2, expanded by 12.9% as reported by the Federal Reserve. Such an increase indicates more money circulating in the economy, often leading to higher prices. Experts like Jerome Powell, Chairman of the Federal Reserve, underscore the importance of monitoring both M2 and inflation expectations.

Linking it to GDP and Employment

For the real intellectual win, consider the GDP Price Deflator, which adjusts the gross domestic product for inflation, providing a more precise economic snapshot. The U.S. saw a GDP deflator increase of 4.1% in 2021. High inflation can also distort employment figures. The Congressional Budget Office (CBO) reveals that unanticipated inflation can reduce real wages, potentially increasing the natural rate of unemployment.

Understanding these key indicators sets the stage for grasping the multifaceted impacts of inflation, from purchasing power to business costs, all covered in depth in the subsequent parts of this blog series. Discover more on the future unveiled.

Impacts on Consumer Purchasing Power

Consumer Purchasing Power in a High Inflation Environment

Rapid inflation usually triggers a rapid decline in consumer purchasing power. As the consumer price index (CPI) rises, your dollar simply doesn’t stretch as far. The Bureau of Labor Statistics reported that the CPI rose by 6.8% in 2021 alone, which means everyday goods suddenly got a lot more expensive.

Comparative Price Adjustments

When we look back, a McDonald's Big Mac in the U.S. was priced at $3.57 in 2010. By 2022, the price had jumped to around $5.81, showing a direct hit on consumer wallets following inflation trends.

Pressure on Household Budgets

Experts like Jerome Powell, Chair of the Federal Reserve, note how rapid inflation can erode savings and fixed incomes. A Survey of Household Economics revealed that 38% of Americans struggled to cover emergency expenses of $400 in 2022. The volatility in price levels affects how families allocate funds across necessities like groceries, rent, and healthcare.

Income vs. Inflation: A Losing Battle

Wages rarely keep pace with inflation, which worsens the crunch. The Federal Reserve System observed that while wages increased by 4.5%, inflation outstripped this with a 7% rise, leaving workers with an effective pay cut.

Impact of Interest Rate Fluctuations

Adding to the woes, high inflation often compels the Fed to hike interest rates to stabilize the economy. As interest rates rise, the cost of borrowing goes up, making everything from mortgages to credit card debt more expensive. The average 30-year fixed mortgage rate climbed from 3.11% in December 2021 to 5.25% a year later, significantly impacting housing affordability.

Global Perspective

This issue isn’t confined to the U.S. The European Central Bank reported inflation rates of 7.4% for the Eurozone in 2022, leading to widespread economic challenges across continents. Emerging economies, particularly those heavily reliant on imports, also suffer as their purchasing power declines.

Business Cost Increases: Navigating Cost-Push and Demand-Pull Inflation

Deciphering Cost-Push Inflation

One of the primary culprits of rising business costs is cost-push inflation. This occurs when the cost of production, influenced by the price of inputs like raw materials, increases. Such pressures lead businesses to hike up prices for final goods and services. According to a report by the Bureau of Labor Statistics (BLS), in June 2022, energy prices surged by 41.6%, a record spike that drove up production costs across various sectors (BLS, 2022).

Expert Insight: David Blanchflower, former member of the Monetary Policy Committee of the Bank of England, noted, "Cost-push inflation is particularly dreadful because it eats into corporate margins and bleeds through to consumers, leading to a vicious cycle of price hikes."

Demand-Pull Inflation and Business Dynamics

In contrast, demand-pull inflation occurs when the demand for goods and services outpaces supply. Think of the COVID-19 pandemic recovery phase when pent-up consumer demand pressured supply chains. According to a study by the National Bureau of Economic Research (NBER), consumer spending in the U.S. rose by 10.7% in the first quarter of 2021 (NBER, 2021), exerting significant inflationary pressure as businesses struggled to meet demand.

Case Study: Car manufacturers experienced cost-push inflation due to semiconductor shortages and demand-pull inflation from surging post-pandemic car purchases. The result was an aggregate price level increase of approximately 12.2% for new vehicles within a year, as reported by the Consumer Price Index (CPI).

Wages, Profit Margins, and Operational Strain

Rising business costs aren't just about materials. Labor costs also play a big role. Firms may face pressure to increase wages to retain talent amid inflation. A survey by the Council of Economic Advisers indicated that 62% of businesses in the U.S. reported wage increases in 2021 to counter inflation, which subsequently led to higher final product prices (CEA, 2021).

Tony Robbins, a recognized economic strategist, pointed out, "Businesses reeling under rapid inflation may compromise profit margins initially, but invariably, they’ll push these costs onto consumers. It’s an inevitable domino effect in the economic chain."

Strategies and Adaptation

With both cost-push and demand-pull pressures, businesses must adapt. Some strategies include enhancing pricing strategies, optimizing supply chains, and investing in technology to reduce production costs. A successful case is Procter & Gamble's decision to increase prices while simultaneously innovating their product lines, managing to maintain consumer loyalty and balance their margins.

Interest Rates and Monetary Policy: The Fed's Response

The Fed's Balancing Act: Interest Rates and Monetary Policy

When we talk about rapid inflation, the elephant in the room is always the Federal Reserve. This institution, sometimes affectionately called the Fed, plays a pivotal role in managing the U.S. economy’s monetary policy. The Fed's main tool for controlling inflation? Interest rates.

How Interest Rates Fight Inflation

Interest rates are like the gears of an economy. By adjusting them, the Fed influences everything from consumer spending to business investments. When inflation rates spike, the Fed typically raises interest rates to cool things off. According to a Federal Reserve report, a rise in rates makes borrowing more expensive, which, in turn, reduces the money supply circulating in the economy.

The Bureau of Labor Statistics reported that in 2022, inflation reached 8.5%, marking the highest inflation rate since 1981. During such times, the Fed raises the federal funds rate to curb excessive spending and bring down inflation. As per the FOMC's 2023 review, a 0.75% hike in interest rates was implemented, which started showing effects within six months.

Pros and Cons: The Trade-Offs of Higher Rates

However, raising interest rates isn't without its downsides. Some experts argue that increasing rates too aggressively can stifle economic growth. According to Jerome Powell, the Chairman of the Fed, “While higher interest rates help control inflation, they can also slow down the economy, affecting employment rates and investment growth.” This delicate balancing act between controlling inflation and promoting economic stability is the Fed's ongoing challenge.

Adjustments in Monetary Policy

The Fed also employs other tools to combat inflation, such as open market operations and adjusting reserve requirements. According to the Bureau of Economic Analysis, changes in these policies affect the money supply and, consequently, the inflation rate. For instance, during a rapid inflation period, the Fed might sell government bonds in the open market, reducing the money supply and putting downward pressure on prices.

Consumer Impact and Real Interest Rates

For the everyday consumer, these policy changes have tangible impacts. An increase in interest rates often results in higher mortgage payments, more expensive car loans, and steeper credit card interest rates. The real interest rate, which is the nominal interest rate adjusted for inflation, tends to rise during these periods, affecting savings and investment returns. A report by the Bureau of Economic Analysis indicated that savings rates decrease as people are discouraged from borrowing and spending, thus cooling the economy.

Global Implications of U.S. Monetary Policy

It's not just the U.S. that feels the impact. When the Fed adjusts interest rates, global financial markets often react. Higher U.S. interest rates can attract foreign investments, appreciating the dollar and impacting global trade balances. The Federal Reserve System effectively has a hand in the global economy, influencing everything from emerging markets in Asia to established economies in Europe.

Understanding how the Fed balances its role in mitigating inflation while promoting economic stability gives us insight into the complex web of economic policies. As we move forward, watching these interest rate adjustments will be key to understanding the broader picture of economic health.

Impact on Investments and Savings

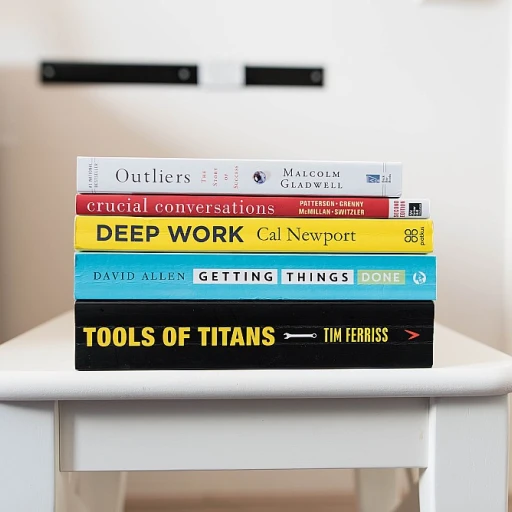

Investment Risks and Opportunities

Rapid inflation can significantly alter your investment landscape. When inflation spikes, traditional investments such as bonds might underperform due to their fixed interest rates, which fail to keep up with rising prices. According to a Bureau of Labor Statistics (BLS) report, the Consumer Price Index (CPI) surged by 5.4% year-over-year in the U.S. at one point recently. Notably, high inflation often leads investors to flock to commodities like gold, which has historically been a hedge against inflation.

Savings Erosion

Inflation doesn’t just impact your investments—your savings are at risk too. With the real interest rate being negative (the difference between nominal interest rates and inflation), the purchasing power of your saved money might dwindle. For example, the Federal Reserve estimated that, during periods of high inflation, the real interest rate can drop significantly. Economist Stanley Fischer noted, "Inflation is the most serious threat to anyone relying on fixed-income investments.".

Impact on Stock Market

High inflation can have a mixed impact on the stock market. While companies can sometimes pass increased costs onto consumers, leading to higher revenues, the higher input costs can squeeze profit margins. According to the S&P Global report, sectors like energy and consumer goods often benefit during inflationary times, whereas utilities and banks might suffer due to rising costs and interest rates.

Real Estate as a Hedge

Real estate often serves as a hedge against inflation. As prices rise, property values and rental incomes typically increase, offering a buffer against inflation. The American Enterprise Institute highlighted that, during the 1970s, real estate provided returns of over 6% during a period of high inflation. This makes real estate investments appealing when inflation rates soar.

Cryptocurrencies and Alternative Investments

Amid economic turbulence, cryptocurrencies like Bitcoin have gained traction as inflation hedges. Bitcoin’s limited supply makes it a potential store of value, akin to gold. According to CoinMarketCap, Bitcoin’s price increased by over 300% during recent inflation surges, suggesting it may hold promise for risk-tolerant investors looking for alternatives.

Expert Insights on Diversification

Experts like Jerome Powell of the Federal Reserve advise diversification to manage inflation risks. Powell emphasizes that investors should not put all their eggs in one basket and suggests a portfolio balanced with stocks, bonds, real estate, and alternative assets to navigate through inflationary periods effectively. This balanced approach can provide resilience against market volatility fueled by inflation.

Global Ramifications: Inflation Beyond the U.S.

Ripple Effects on International Trade

Rapid inflation in the United States can cascade into the global economy, impacting international trade relationships. The U.S. Census Bureau reports that U.S. imports and exports were valued at $2.8 trillion and $1.4 trillion respectively in 2022. Such staggering numbers signify how fluctuations in the U.S. economy can alter global trade dynamics.

Exchange Rate Volatility

Inflation often leads to a depreciation of the national currency. Data from the Federal Reserve indicates that higher inflation rates typically coincide with a weaker U.S. dollar. This currency volatility affects everything from foreign investments to the cost of imported goods, leading to price increases in countries heavily reliant on U.S. imports.

Foreign Direct Investment Impacts

Countries with rapid inflation face a decrease in foreign direct investments (FDI). According to the World Bank, FDI inflows to the U.S. fell by 15% during periods of high inflation between 1970 and 1980. Investors seek stable economies, and rapid inflation deters foreign investments, impacting long-term economic growth.

Comparative Inflation in the Eurozone

The European Central Bank (ECB) reported an inflation rate of 8.6% for the Eurozone in 2022, largely driven by the global economic impact of the COVID-19 pandemic, the war between Russia and Ukraine, and supply chain disruptions. These factors illustrate how interconnected economies ripple through monetary systems across the globe.

Insights from Experts

Jerome Powell, current Chair of the Board of Governors of the Federal Reserve System, stated, “Inflation affects not only domestic economies but also international trade and investments.” His insights were echoed by Christine Lagarde, President of the ECB, who noted, “Inflation in one significant economy like the U.S. has global ramifications, altering financial behaviors worldwide” (ECB Press Release).

Monetary Policy Coordination

Coordination among central banks is critical during inflationary periods. The International Monetary Fund (IMF) emphasizes the necessity for synchronized monetary policies to mitigate the adverse effects of inflation globally. Collaborative efforts between the U.S. Federal Reserve, ECB, and other central banks aim to stabilize the global economy.

Global Supply Chain Disruptions

Supply chain issues are among the early victims of inflation. According to the Federal Reserve's Beige Book, “manufacturing and logistic challenges across economies globally were exacerbated by inflation.” The disruption affects everything from raw materials to consumer goods, escalating prices and causing delays.

Real-World Examples and Case Studies

The COVID-19 pandemic provided a stark example of cross-border inflation effects. When inflation jumped nearly 5% in the U.S. in the second half of 2021, it caused price surges in imported goods from China, Europe, and Latin America. A report by the Bureau of Labor Statistics demonstrated that consumer prices rose by 4.7% in 2021, causing a ripple effect on global prices.

Consumer Behavior Shifts During Rapid Inflation

Shifts in Consumer Spending Habits

When inflation skyrockets, consumers adapt their spending in remarkable ways. The Bureau of Labor Statistics reported that in 2022, the Consumer Price Index (CPI) increased by 6.8% – the highest in nearly four decades. With prices for goods and services inflating, households are forced to make tough choices.

Downsizing on Luxuries: Families prioritize essentials over luxury items. For instance, a survey by NielsenIQ revealed that 65% of consumers planned to reduce their spending on dining out and entertainment.

Increased Demand for Discount Stores

High inflation pushes shoppers toward discount retail options. Dollar stores have seen a boom, with chains like Dollar General and Dollar Tree reporting a substantial uptick in sales. This trend amplifies during economic stress, as confirmed by Stanley Peterson, an economic analyst with extensive study in retail consumer patterns.

Delayed Major Purchases

When inflation hits, big-ticket items like cars, appliances, and homes become less attainable. Data from the Federal Reserve Bank of St. Louis shows that automobile sales plummeted by 20% during the recent inflationary surge, as consumers postponed or canceled purchasing plans.

Rise of Private Labels

Consumers switch to private-label brands to offset soaring prices. According to the Private Label Manufacturers Association, sales of store brands grew by 10% in grocery stores during the recent inflationary phase. These products can be 20-25% cheaper than their branded counterparts, making them an attractive alternative.

The Psychological Impact

Rapid inflation also triggers a significant emotional response. Anxiety about rising costs and economic uncertainty can lead to increased saving behaviors. A study by the University of Michigan found that consumer sentiment took a sharp nosedive by 30% in response to inflation concerns, impacting the overall demand for non-essential goods.

Case Studies: Real-World Examples of Inflation's Effects

Germany's Hyperinflation in the 1920s

Germany's hyperinflation in the 1920s remains one of the most cited examples when discussing the drastic effects of rapid inflation. Official data indicate that in 1923, prices in Germany were doubling roughly every four days. This relentless price surge was due in part to the overproduction of currency to pay war reparations post-World War I, leading to an astronomical inflation rate.

By November 1923, inflation peaked to the point where 1 U.S. dollar was equivalent to 4.2 trillion German marks. Historian Niall Ferguson notes that such rapid inflation obliterated the middle class's lifetime savings and caused widespread economic hardship. This historical account underscores how unchecked inflation can destabilize an entire economy.

Zimbabwe's Economic Collapse

Another vivid example is Zimbabwe in the late 2000s. The International Monetary Fund (IMF) reported that Zimbabwe experienced an annual inflation rate of 89.7 sextillion percent by November 2008. The rapid inflation decimated the currency's value, leading citizens to resort to bartering for essentials.

According to economist Steve H. Hanke of Johns Hopkins University, Zimbabwe's hyperinflation peaked at 79.6 billion percent month-on-month in mid-November 2008. Businesses were forced to rewrite price lists several times a day, and shelves remained empty as goods became unaffordable to most citizens. This scenario demonstrates how rapid inflation, especially when it spirals into hyperinflation, can push an economy to the brink of collapse.

Impact on Argentina's Economy

Argentina's experience with inflation in the late 20th century and early 2000s provides a modern perspective on the issue. According to the BBC, inflation in Argentina skyrocketed to approximately 3,000% per year in 1989. Despite several monetary policies aimed at stabilization, the inflation problem persisted.

Economist Miguel Angel Broda highlights that the persistent inflation led to frequent currency devaluations, eroding the purchasing power of Argentine citizens. The instability has continued into the 21st century, with inflation rates hitting 50.9% in 2021, as reported by Argentina's National Institute of Statistics and Census (INDEC). This prolonged period of inflation has perpetuated economic uncertainty and hindered growth.

Turkey's Recent Experience

Turkey provides an example of modern-day inflationary effects. According to the Turkish Statistical Institute, inflation in Turkey reached 36.08% in 2021. The rapid rise in prices significantly affected purchasing power and caused public unrest.

President Recep Tayyip Erdogan's unorthodox monetary policies, which included lowering interest rates to combat inflation, contributed to the inflationary surge. As a result, the value of the Turkish Lira plummeted, leading to increased import costs and further fueling inflation.

Expert Insights on Inflation's Effects

Financial analyst Mohamed El-Erian emphasizes that rapid inflation impacts not only individual purchasing power but also business operations, interest rates, and global economic stability. As El-Erian notes, understanding the multifaceted nature of inflation is crucial for policymakers to develop effective strategies.

Economist Paul Krugman also weighs in, stating, "Inflation is a complex phenomenon, and its effects are pervasive... Managing it requires a delicate balance of monetary and fiscal policies." His words resonate with the experiences of the countries mentioned, highlighting the need for informed, balanced approaches to tackling inflation.